Savannah Energy Posts Record Cash Collections, Sustained Growth in 2024 Operations

Savannah Energy PLC, a British independent energy company committed to delivering impactful projects, has provided a comprehensive trading update on its Nigerian operations and other ventures across Africa.

The report, reflecting financial and operational highlights for the financial year 2024, underscores the company’s steady growth, record cash collections, and progress in renewable energy initiatives.

The update revealed that Savannah’s gross production in Nigeria averaged 23.1 Kboepd in 2024, maintaining a stable performance compared to the 23.6 Kboepd recorded in 2023.

Gas production constituted 88% of the output, slightly lower than the 91% recorded in 2023.

The company’s total income for 2024 stood at an impressive $393.6 million, a 36% increase from the $289.8 million recorded in 2023.

This includes total revenues of $258.7 million, surpassing the financial guidance of $245 million, and other operating income of $134.9 million, significantly up from $28.9 million in 2023.

Cash collections hit a record $248.5 million in 2024, a notable rise from the $206 million received the previous year.

However, cash balances as of 31 December 2024 stood at $32.6 million, a decline from $107 million in 2023, primarily due to prepayments on existing facilities.

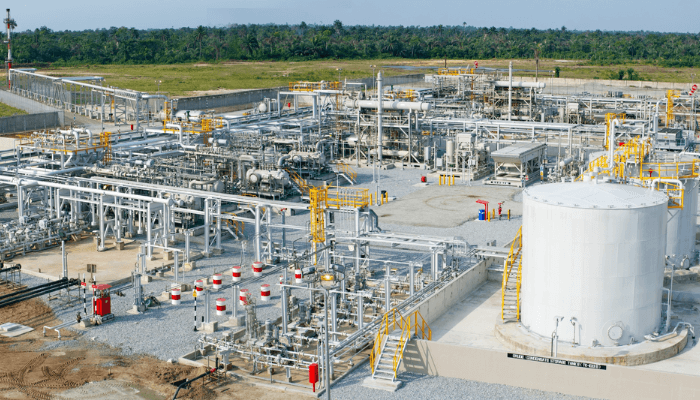

Savannah’s midstream subsidiary, Accugas Limited, utilised funds from its NGN 332 billion Transitional Facility to partially prepay its US$ Facility, leaving a balance of $212.3 million at the end of 2024.

Additionally, the $45 million Uquo Central Processing Facility compression project is nearing completion, which is expected to enhance medium-term gas production.

In preparation for a potential two-well drilling campaign on the Uquo Field in the second half of 2025, Savannah has initiated the procurement of long lead equipment.

This campaign aims to add up to 80 MMscfpd of supplemental gas production and explore 154 Bscf of gross gas resources.

The company is also making strides in acquiring Sinopec International Petroleum Exploration and Production Company Nigeria Limited, which holds a 49% stake in the Stubb Creek oil and gas field.

Regulatory approvals are expected by Q1 2025, with plans to expand Stubb Creek’s gross production from 2.7 Kbopd in 2024 to 4.7 Kbopd.

Savannah Energy continues to champion Africa’s renewable energy transition.

The company is advancing up to 696 MW of renewable energy projects, including the Parc Éolien de la Tarka wind farm in Niger and the Bini a Warak hybrid hydroelectric and solar project in Cameroon.

It aims to expand its renewable energy portfolio to over 2 GW by 2026.

In Niger, Savannah is progressing its R3 East oil development, which boasts 35 MMstb of gross 2C resources.

Meanwhile, in South Sudan, the company is exploring alternative transaction structures to acquire a significant stake in producing oil and gas assets.

CEO’s Statement

Andrew Knott, CEO of Savannah Energy, remarked:

“I am pleased to provide a FY trading update which demonstrates the continued progress we have made in 2024, a year which saw the highest level of cash collections ever recorded by our Nigerian business.

“2025 is expected to be an exciting year for our company: we have a large planned operational programme in Nigeria which is anticipated to enhance both our oil and gas production levels and capacity; we intend to progress our R3 East oil development project in Niger; we continue to pursue key acquisitions in the upstream oil and gas space; and we continue to seek to build our power business.”

With a steadfast commitment to both hydrocarbons and renewable energy, Savannah Energy remains poised for short- and long-term growth, driving sustainability and economic development across Africa.