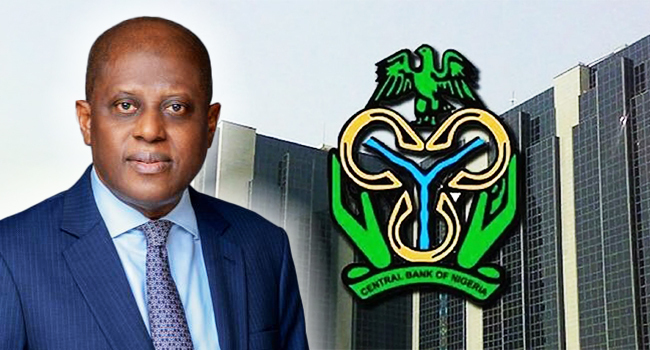

CBN Governor Warns of Dormant Account Fraud, Announces Interest Rate Hike

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has raised concerns about the vulnerability of dormant bank accounts to fraud.

Speaking at the conclusion of the 296th meeting of the Monetary Policy Committee (MPC) on Tuesday, Cardoso also announced a further increase in the benchmark interest rate to 26.75 percent.

Cardoso emphasised the risks associated with dormant accounts, stating, “If you leave accounts dormant in banks, they are more susceptible to fraudsters copying your identity and trying to gain hold of the system to grab your money. This is a problem most banks face.”

In response to this issue, the CBN has directed financial institutions to transfer funds from dormant accounts, unclaimed balances, and other financial assets to the central bank for safekeeping.

The objective is to identify these accounts and reunite them with their rightful owners, standardize the management of such accounts, and establish a procedure for reclaiming these funds.

Cardoso assured that the funds would be held at zero cost to the beneficiaries and returned with accrued income once the rightful owner is identified.

The MPC meeting also discussed the Federal Government’s recently announced 150-day duty-free import window for food commodities such as maize, husked brown rice, wheat, and cowpeas.

The committee expressed optimism that these measures would help moderate domestic food prices without causing further inflation.

However, Cardoso stressed the importance of implementing these measures with a clear exit strategy to avoid undermining recent gains in domestic food production.

He noted that the CBN is working with development finance institutions to support small and medium-scale enterprises in the food sector.

The CBN governor provided an update on Nigeria’s economic performance, noting that the country’s real GDP grew by 2.98 percent year-on-year in the first quarter of 2024, down from 3.46 percent in the fourth quarter of 2023.

The domestic economy is projected to grow by 3.38 percent in 2024, according to CBN staff forecasts, while the International Monetary Fund (IMF) projects a growth rate of 3.1 percent. As of July 18, 2024, Nigeria’s external reserves stood at $37.05 billion, representing 11 months of import cover for goods and services.

The CBN’s latest measures and projections reflect ongoing efforts to stabilise Nigeria’s economy amidst various challenges, including inflation and fraud risks associated with dormant accounts.