How Nigeria’s national ID is among most used documents for identity fraud in Africa

Smile ID, the African identity verification startup founded in 2017, has disclosed its comprehensive yearly report, encompassing over 100 million identity checks conducted across the continent throughout 2023.

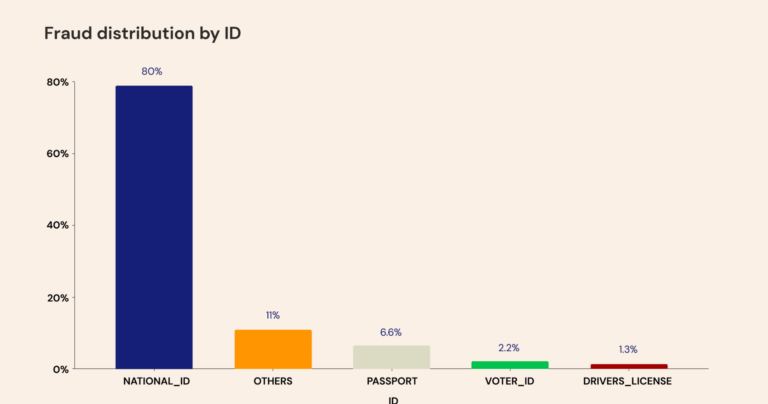

The report reveals a noteworthy trend: fraudulent attempts at identity verification predominantly involve the misuse of national IDs, constituting a staggering 80 percent of all fraudulent attempts using document-based verification.

In the latest findings of Smile ID’s 2024 Digital Identity Fraud in Africa Report, Nigeria is ranked ninth, with an 18 percent fraud attempt rate.

Topping the list is South Africa’s national ID, accounting for 38 percent of fraud attempts, followed by Tanzania at 32 percent, Kenya at 26 percent, and Uganda at 25 percent.

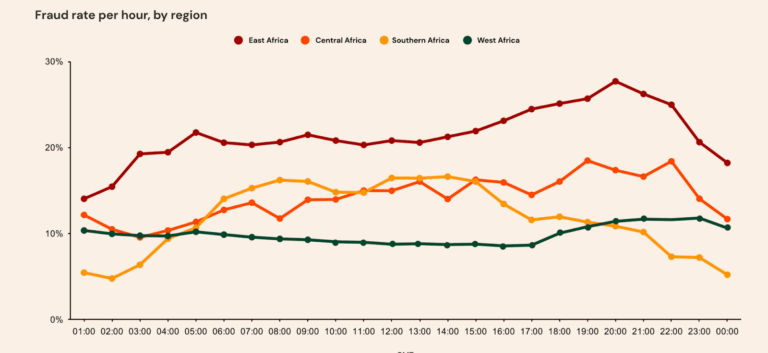

The report further dissects identity fraud trends across Africa, pinpointing Central and East Africa as the regions experiencing the highest rates in 2023, reaching peaks of 29 percent and 30 percent, respectively.

Southern Africa hit a peak of 23 percent, while West Africa recorded the lowest fraud rate at 20 percent.

A meticulous examination of fraudulent activities revealed that peak hours for identity fraud occurred between 6 p.m. and 9 p.m., with Mondays and Wednesdays being the most active days for fraudsters.

Despite relatively consistent identity fraud rates among industries in 2023, the financial sector witnessed a peak in fraud rates in October.

Notably, payment platforms took the lead in fraud attempts, hitting a peak of 43 percent in January, while savings and investment platforms followed closely at 24 percent in October.

The report highlighted a peculiar shift in the Buy Now Pay Later (BNPL) sector, which experienced a surge in fraud rates in 2022, with a peak at 18 percent in April 2023.

Techpoint reports that this rise occurred amidst increased usage and investment in BNPL startups in 2022, such as Kenya’s Lipa Later securing $12 million pre-Series A and Nigeria’s Klump raising $780,000 pre-seed.

CredPal’s collaboration with Bolt to introduce a ride-now-pay-later service also marked a notable development.

Tech experts have attributed the BNPL boom to the lack of credit accessibility in Africa, providing an avenue for ordinary citizens to access credit easily.

Despite this, the report leaves unanswered questions regarding the surge in fraud rates on payment startups, even as major players like Flutterwave suffered a ₦2.9 billion hack, and Interswitch lost ₦30 billion to chargeback fraud.