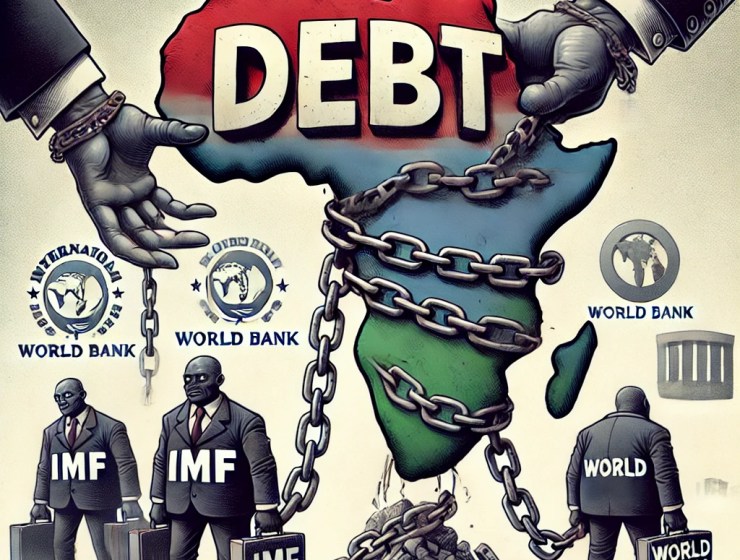

Mounting Debt of African Countries to Int’l Loan Sharks: A Paradox Amidst Abundant Resources

Africa, a continent blessed with immense natural wealth – from vast mineral deposits to fertile lands and a vibrant youthful population – is facing a deepening crisis: an unsustainable dependence on external borrowing.

Despite its abundant resources, many African nations are ensnared in a debt trap that imperils their economic stability, social cohesion, and sovereignty.

Over the last decade, the borrowing spree by African countries has surged to alarming levels, with creditors such as the International Monetary Fund (IMF), the World Bank, and China’s Exim Bank dominating the financial landscape.

While these loans are often aimed at funding infrastructural development, the outcomes have been mixed, leaving nations burdened with mounting debt and dwindling fiscal autonomy.

Ghana: A Case in Point

Ghana has emerged as the second most indebted African nation to the IMF, epitomising a growing trend of reliance on external borrowing despite the continent’s vast mineral wealth.

As of 31st October 2024, Ghana’s exposure to the IMF stood at 2.242 billion Special Drawing Rights (SDR), equivalent to $2.914 billion. This accounted for 17% of Africa’s total borrowings from the IMF.

According to the IMF’s latest Quarterly Finances, Ghana was surpassed only by the Democratic Republic of Congo (DRC), which leads the continent with an indebtedness of 2.256 billion SDR.

Zambia followed closely in third place with an SDR obligation of 1.272 billion. The once promising copper exporter also defaulted on $12 billion in loans in 2020, mainly owed to Chinese lenders.

Over-reliance on commodity exports and resource mismanagement triggered the crisis.

Both Ghana and Zambia have defaulted on previous loans, necessitating financial interventions from the IMF to stabilise their economies.

Apart from Ghana’s indebtedness to the IMF, reports indicate that the West African country has over $30 billion in external debt, including loans from other financial institutions.

The country has entered a restructuring agreement with the IMF, sparking concerns over reduced fiscal sovereignty.

This highlights a troubling paradox for a nation endowed with significant mineral resources, including gold, bauxite, and oil.

Despite these assets, Ghana’s debt exposure remains significant, with concessional loans under the Poverty Reduction and Growth Trust (PRG Trust) exceeding levels recorded in July 2024.

These loans, while offering low-interest financing, underscore the nation’s dependency on external support.

The Bigger Picture

Nigeria: Africa’s largest economy owes over $41 billion in external debt as of 2024. This is attributed to a reliance on dwindling oil revenues and excessive subsidy spending which has compounded its financial strain.

Angola: Angola’s staggering $70 billion debt is primarily tied to oil-backed Chinese loans. Declining oil prices have worsened repayment difficulties.

Mozambique: A 2016 hidden debt scandal pushed Mozambique’s $14 billion debt into crisis, causing economic meltdown and investor flight.

South Africa: The continent’s most industrialised economy faces $175 billion in public debt, exacerbated by slow growth and a weakening rand.

Kenya: A $70 billion debt largely funds infrastructure projects, including the controversial Standard Gauge Railway.

Sudan: Political instability has hampered Sudan’s ability to manage its $60 billion debt.

Tunisia: Post-revolution economic stagnation has left Tunisia grappling with $40 billion in debt.

Critics point to the contradiction of resource-rich nations facing debt crises, highlighting systemic challenges in resource management and governance.

The Cost of Over-Borrowing

The consequences of excessive borrowing are profound and far-reaching:

Loss of Sovereignty: Debt terms often compel governments to prioritise creditors’ interests over national priorities.

Debt Servicing Over Development: Resources needed for health, education, and infrastructure are diverted to service loans.

Economic Instability: Many nations face currency devaluation, inflation, and austerity measures imposed by lenders.

Resource Pledging: Countries like Angola have tied loan repayments to resource exports, risking long-term depletion of natural wealth.

Political Vulnerabilities: External creditors gain significant leverage, increasing susceptibility to foreign interference.

A Call to Action

Africa stands at a crossroads. The current debt crisis serves as a glaring wake-up call for transformative leadership and prudent resource management.

The continent’s vast resources and potential for self-reliance must not be mortgaged to creditors’ interests.

By uniting under a shared vision of financial independence and adopting sustainable economic strategies, African nations can break free from debt dependency.

The journey will be arduous, but the promise of sovereignty, stability, and prosperity for future generations makes it an imperative worth pursuing.

The choice is clear: embrace the hard path to independence or risk perpetuating a cycle of economic subjugation. The time to act is now.