Nigeria Customs Deepens Strategic Ties with Access Bank to Bolster Trade System Integration

…As DCG ICT Reaffirms Commitment to Seamless Financial Collaboration

The Nigeria Customs Service (NCS), in a bid to consolidate the gains of its newly deployed Unified Customs Management System (UCMS), codenamed B’odogwu, has intensified its stakeholder engagement efforts, with a renewed focus on financial institutions.

On Monday, 14 April 2025, the Service held a high-level virtual meeting with officials of Access Bank to explore avenues for deeper collaboration aimed at streamlining payment systems, enhancing data exchange, and supporting seamless financial integration within Nigeria’s trade ecosystem.

The meeting was led by Deputy Comptroller-General of Customs in charge of ICT and Modernisation, Kikelomo Adeola, who was joined by the Service’s National Public Relations Officer, Assistant Comptroller Abdullahi Maiwada, and Assistant Comptroller Bukola Omoniyi from the ICT/Modernisation Department.

Central to the discussions was the post-deployment phase of B’odogwu, an indigenous digital solution designed to unify Customs procedures, automate declarations, and enable real-time transaction monitoring across the trade value chain.

DCG Adeola reaffirmed the Service’s commitment to fully integrating key stakeholders within the platform. “The deployment of B’odogwu marks a new era in Customs administration,” she stated. “Our next priority is to strengthen partnerships with financial institutions like Access Bank to fully unlock the platform’s potential for automation, transparency, and trade efficiency.”

She further emphasised the strategic importance of ensuring all players within the trade value chain are seamlessly integrated. “To achieve optimal functionality, full stakeholder collaboration is essential. This engagement with Access Bank is not just timely—it is strategic,” she added.

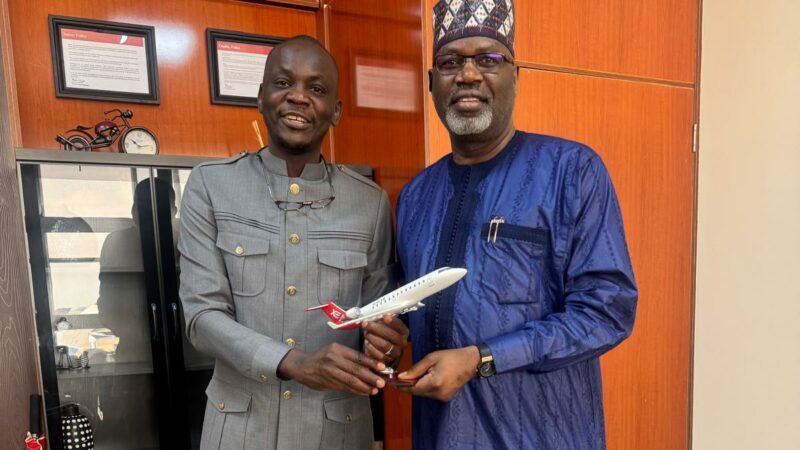

In response, Olatunbosun Oladunke, Head of Global Trade at Access Bank, lauded the Customs Service for its forward-looking digital transformation agenda.

“The B’odogwu platform represents a major leap in digital trade processing. Access Bank is fully aligned with the NCS vision and is committed to ensuring system compatibility—particularly in trade finance and payment automation,” he said.

Also present at the meeting was Olakunle Aderinokun, Head of Media and Public Relations at Access Holdings/Access Bank, who underscored the importance of public engagement in sustaining reform efforts.

“Public buy-in is critical to the success of any reform. We will collaborate with the Service to drive awareness of B’odogwu and educate stakeholders on the value it brings to the trading ecosystem,” he remarked.

The engagement with Access Bank forms part of a broader NCS strategy to fast-track trade modernisation through strategic partnerships, enhanced transparency, and continuous innovation.

With B’odogwu now fully operational, the NCS is steadily advancing towards a digitally integrated, efficient, and globally compliant Customs system, in line with the nation’s economic growth ambitions.